Anytime Fitness, Everlast Fitness, Fitness Space, Pure Gym, Snap Fitness and The Gym Group are private UK fitness brands which opened new clubs in January 2018. Will the UK fitness industry continue to see growth throughout the year, with the private sector as the main driving force?

November: Gym Owner Monthly

UK Fitness Members

The 2017 State of the UK Fitness Industry Report states that membership within the UK gym sector is growing. In 2015, the total number of fitness members was 8.8 million which increased to 9.7 million in 2017. For the first time in 2016, the total number of fitness members exceeded 9 million. Will 2018 be the year that membership surpasses 10 million?

Original Source: Gym Owner Monthly

IHRSA European Congress, London

David presented at the IHRSA European Congress on Wednesday. His presentation looked at the state of the European fitness markets, particularly within the UK. He also led a tour group around 3 Central London clubs; Third Space Soho, EasyGym Oxford Street and the Oasis Sports Centre, Covent Garden.

Here are some infographics used in his presentation...

October: Gym Owner Monthly

Public Sector

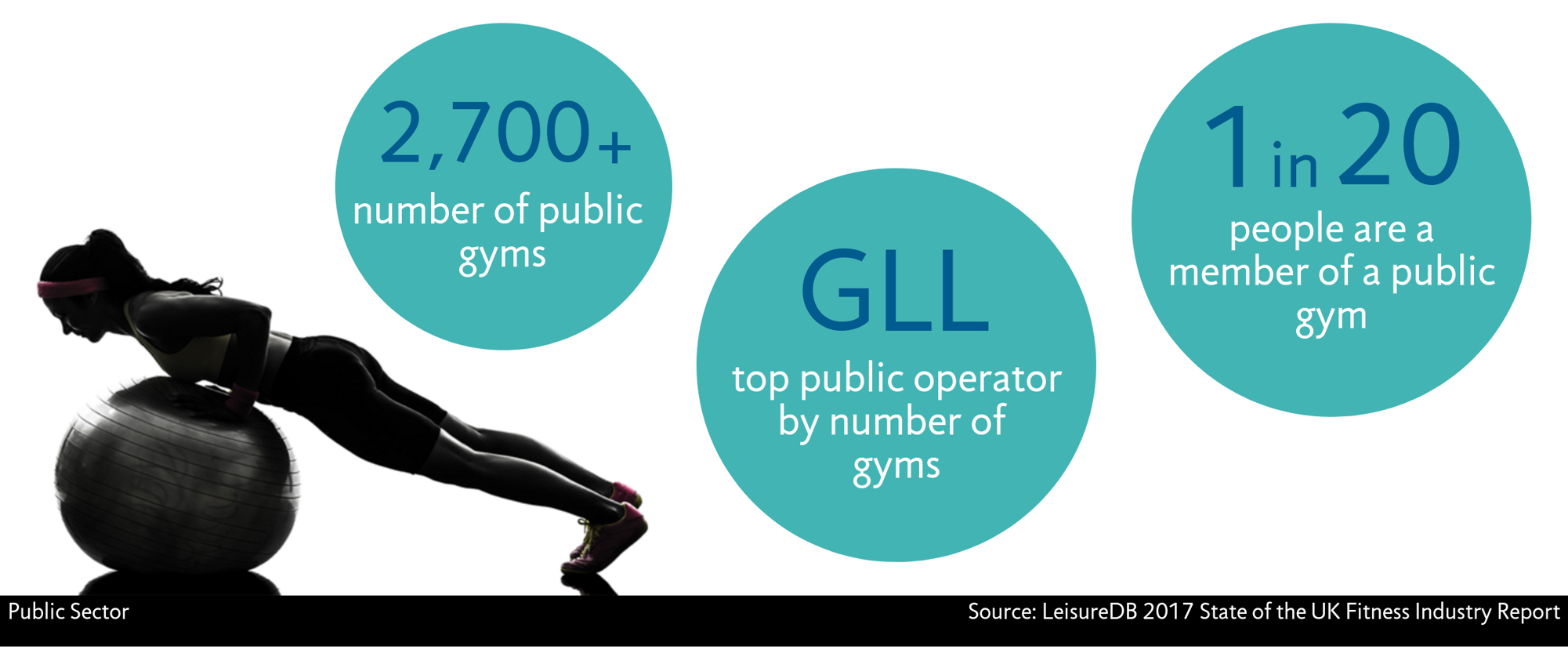

The 2017 State of the UK Fitness Industry Report reveals that 1 in every 20 people are members of a public gym. The public sector has over 2,700 gyms across the UK and Greenwich Leisure Limited (GLL) is the top operator. For the first time in five years, the public sector has seen a slight decline in membership numbers. Is this due to a combination of operating budgets being reduced and the impact of the private low cost market?

Original Source: Gym Owner Monthly

September: Gym Owner Monthly

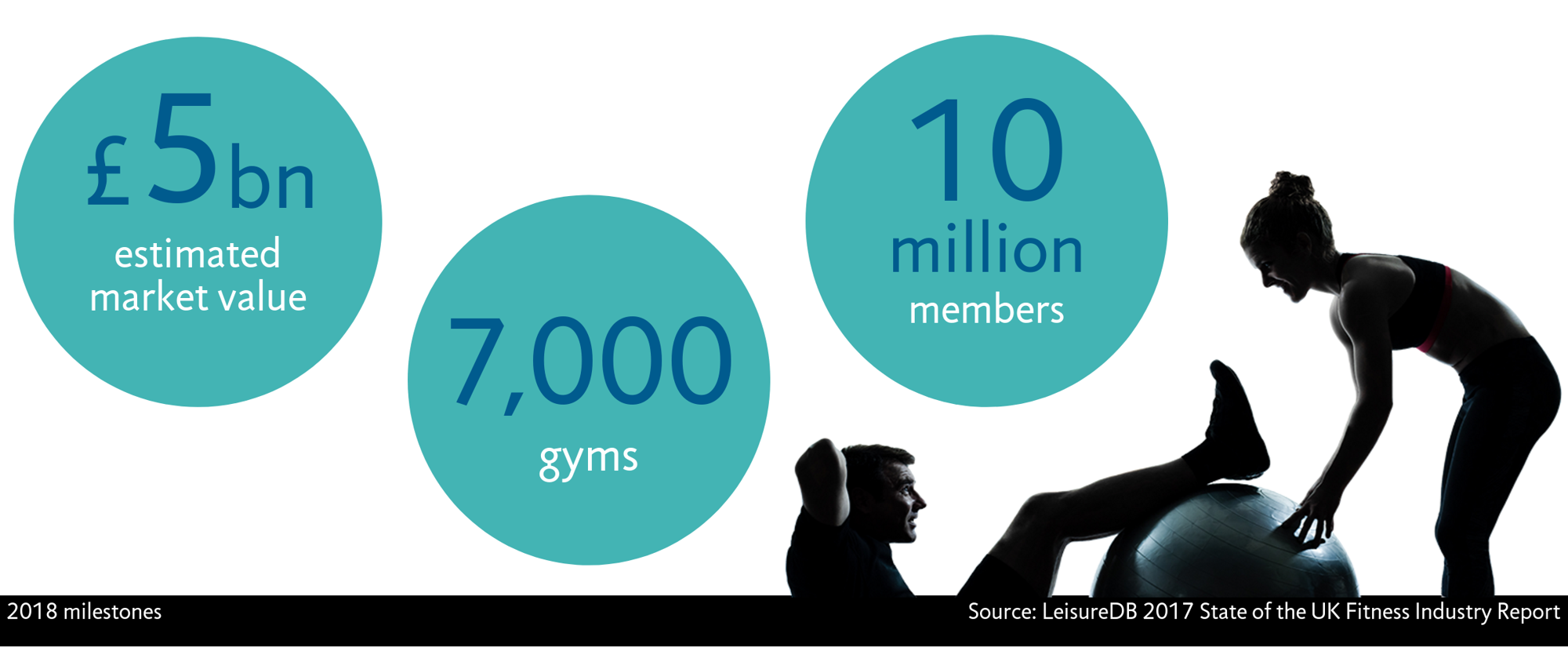

2018 Milestones

The 2017 State of the UK Fitness Industry Report revealed that the UK health and fitness industry is continuing to grow. David Minton, Director of LeisureDB said: “It may be premature to call the period to 2020 “the golden age of fitness” but further growth will only be limited to the imagination of those pushing the boundaries. The signs are there that the industry is likely to hit several milestones in 2018. The number of gyms is on course to go over 7,000 for the first time, total membership to exceed 10 million and market value to reach £5 billion”.

Original Source: Gym Owner Monthly

August: Gym Owner Monthly

The private low cost market

The 2017 State of the UK Fitness Industry Report reveals that the UK health and fitness industry is continuing to grow. This growth is being primarily driven from the private sector, which has more clubs, more members and a greater market value than ever before.

The low cost market has continued to be the main driving force behind the private sector growth. There are now over 500 low cost clubs which account for 15% of the market value and 35% of membership in the private sector. The UK’s leading low cost operator is Pure Gym with over 180 gyms.

Original Source: Gym Owner Monthly

You And Yours - BBC Radio 4

David spoke with Samantha Fenwick, a reporter for 'You and Yours' (BBC Radio 4 programme) about the UK fitness industry. The number of gym memberships are increasing every year and David says that "group fitness is driving the industry growth as classes are no longer held in boring studios...operators are making gym experiences more enjoyable". Les Mills UK and Sport England commented on the increase in group exercise participation and how technology, such as virtual reality, will change group fitness forever.

Listen to the full clip here: http://www.bbc.co.uk/programmes/b08x4rf3

July: Gym Owner Monthly

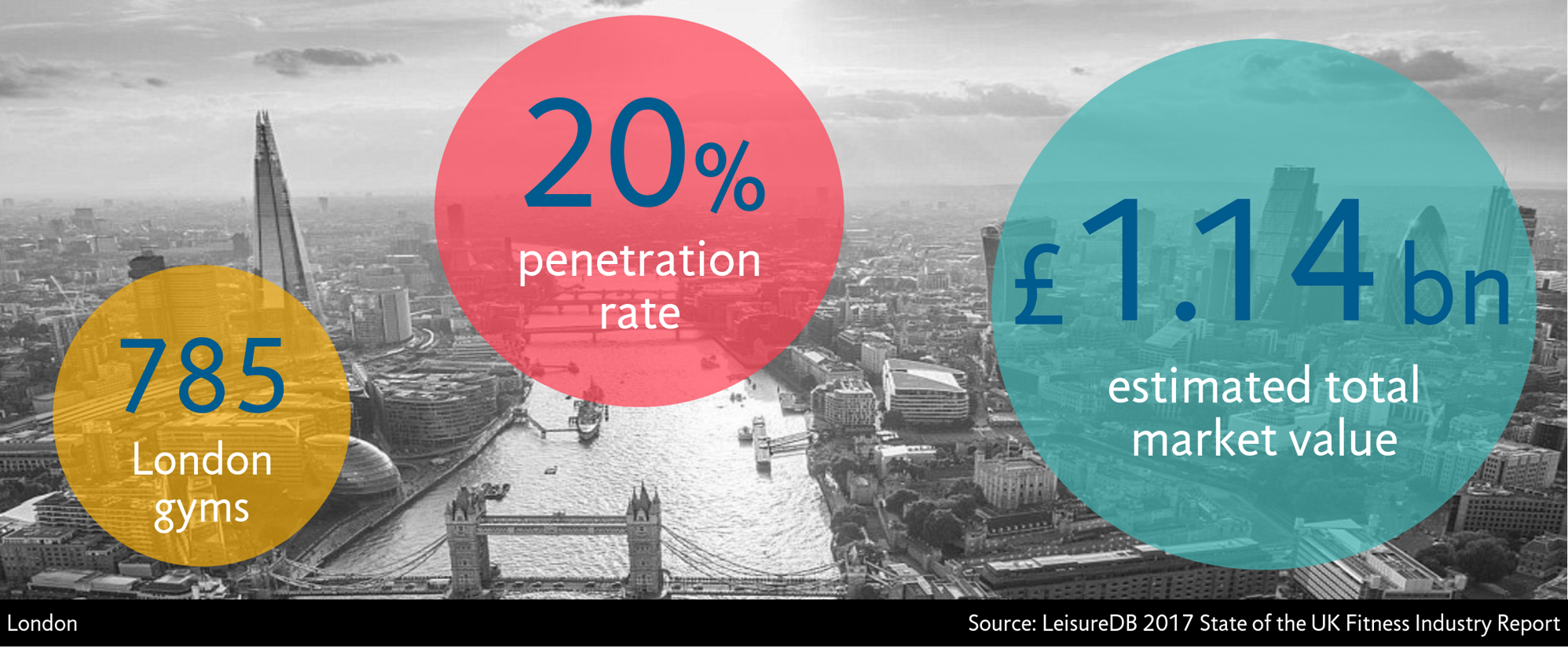

Focus on London...

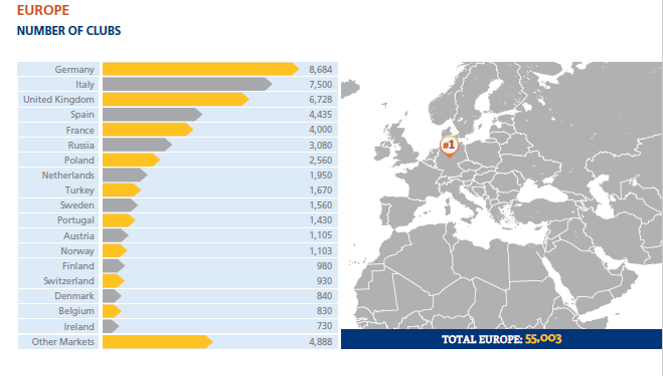

The 2017 State of the UK Fitness Industry Report reveals that there are now 6,728 fitness facilities in the UK with 12% of the sites being in London.

London alone has a staggering 1.7 million fitness members, that’s 1 in every 5 people in London being a member of a gym compared to 1 in every 7 within the UK.

The fitness industry within London has a market value of £1.14 billion (24% of the overall UK market value) and a penetration rate of 20%.

Original Source: Gym Owner Monthly

The 2017 IHRSA Global Report

The 2017 IHRSA Global Report was published today and it shows that the global health club industry continues to grow. In 2016, the industry revenue totalled $83.1 billion, as 162.1 million members visited 201,000 clubs.

LeisureDB's 2017 State of the UK Fitness Industry report findings were featured in the report:

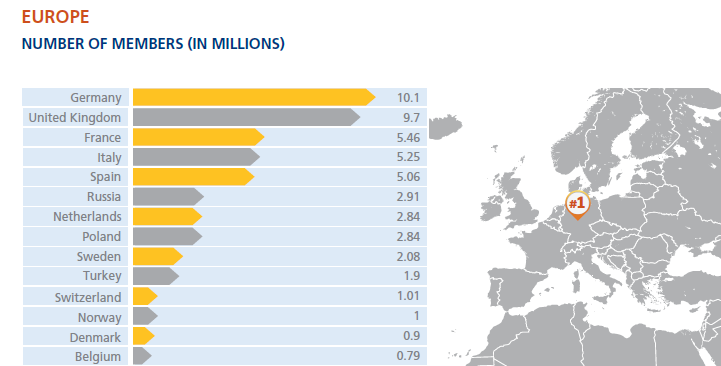

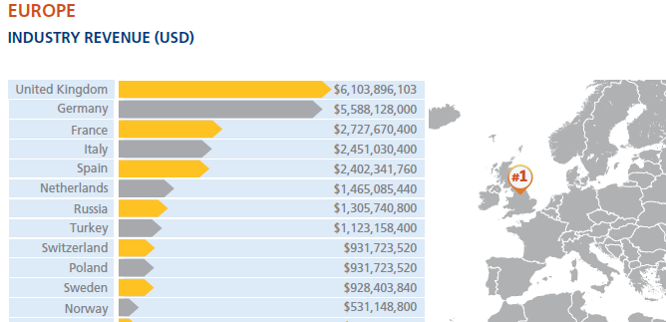

Europe

In spite of a weakening Euro and challenges in the political landscape, the fitness industry in Europe continues its robust performance. The European health club market serves more than 56 million members as nearly 55,000 health clubs generate $29 billion in revenue. The UK and Germany continue to lead all markets in Europe. In the UK, based on research by LeisureDB, 9.7 million members belong to a health club, up from 9.3 million a year ago. Approximately 6,728 facilities in the UK generate a collective $6.1 billion in industry revenue. Germany attracts more than 10 million members to 8,600 facilities and generates $5.6 billion in revenue.

The 2017 IHRSA Global Report can be purchased here.

The 2017 State of the UK Fitness Industry Report can be purchased here.

We've been quoted!

Following the release of the 2017 State of the UK Fitness Industry report we're pleased to announce our stats have been quoted across the media!

The Guardian - "The budget gym boom: how low-cost clubs are driving up membership"

The Times - "It's Life, Gym"

The Times - "Budget gyms are flexing their muscles"

Leisure Opportunities/Health Club Management - "Private sector drives UK fitness industry growth"

Fitness News Europe - "Public sector dip in buoyant UK market"

2017 STATE OF THE UK FITNESS INDUSTRY REPORT - OUT TODAY

The 2017 State of the UK Fitness Industry Report reveals that the UK health and fitness industry is continuing to grow. This growth is being primarily driven from the private sector, which has more clubs, more members and a greater market value than ever before.

There are now over 9.7 million fitness members in the UK which has boosted the penetration rate to an all-time high of 14.9%. 1 in every 7 people in the UK is a member of a gym.

Read MoreTech Will Shape Our Industry

Gerald Ratner, in 1991, achieved notoriety in the UK after making a speech in which he jokingly denigrated two of the jewellery products sold by his company. The so called ‘Ratner Effect’ caused the company’s near collapse. In the USA the hashtag #DeleteUber started trending in January and so far, 2017 for Travis Kalanick, Uber’s CEO, it’s been annus horribilis. Although Kalanick has stepped down from Trump’s advisory council, prompting another mea culpa, the embattled ride hailing company is still surrounded by controversy. Uber’s troubles have resulted in market share gains for Lyft, it’s main competitor, according to TXN Solutions which tracks debit and credit spending. Uber spend across the US has declined since January by 2% while Lyft has jumped 30% on average. In Uber’s home city, San Francisco, spend was down 8% while Lyft jumped 24%.

For IHRSA attendees in Los Angeles the ride hailing service Lyft became the de facto service and for those with ApplePay, a Lyft (get it?) was just a finger touch away…how simple and intuitive. Lyft’s use of the latest technology provides a seamless digital gateway of choice and many lessons for the fitness industry. Consumers are in control and brands need to stop interrupting with bad technology and trying to sell unwanted products or services and instead start having smart conversations and start listening. Lyft has that conversation and is listening after every ride and if it wasn’t perfect, how could it have been better. When did you receive a request to rate your instructor, the class, the PT, the club even. For me? Never. Those fitness brands who offer transparency of pricing are growing faster than ever and the same brands are open about the good, and maybe not so good, conversations they are having with their customers but they listen and respond. Peer reviews of the workout, instructors and the all-important experience keeps everyone on their toes.

At the Networking Roundtable chaired by Bryan O’Rourke, operators degraded the heritage CRM systems that the industry is suffering under. So, will traditional CRM systems be dead in 5 years time? Probably. Some heavy competition is being tested in California. Reserve with Google, gives deeper booking integration so local search, which relies on live timetable APIs, becomes more transactional. Previously booking buttons would link away to a third party provider but now its deeply integrated. Mindbody, Full Slate, Front Desk, Appointy are all currently live on Reserve with Google and ZingFit, MyTime and Genbook are coming soon. Only Mindbody were demonstrating this integration at IHRSA but hopefully all will be there next year in San Diego. More competition is coming from Facebook who have recently added local reservations and integrated bookings. Its Events calendar has been turned into a standalone app, allowing groups of friends to book and buy activities together. Airbnb are linking the consumer to a world of fitness experiences which taps Airbnb’s community to offer highly curated opportunities. Even Yelp is accelerating adoption of local listings to include payments and bookings. It won’t be long before Amazon make an announcement in this area, linked to Alexa searches. All these companies, plus Apple, have fitness teams analysing the industry and how they can disrupt it, search and bookings is an obvious one.

Reserve with Google was live in LA so IHRSA delegates could logon to experience the granular search, from APIs of live timetables, linked to seamless integrated booking. Reserve puts the consumer at the centre of the search and through Artificial Intelligence (AI), constantly learning what type of class or activity you like, will deliver your personalised push notifications that addresses the question of which class, where and what time before you’ve thought of it. Those poised to take advantage of this new era are the boutiques, fitness without boundaries, community activities and meet-ups. In the UK public sector sites and trusts have been early adopters of live timetables and APIs, concretely demonstrating the value of digital. For those of you who are still using Pdf’s, and heaven forbid, a Pdf on an app, then help is at hand. AiT (Active in Time) http://info.activeintime.com/operator-software-explained/ a UK start-up company provide the free software and for a small monthly charge APIs for those who want to be part of the digital revolution. Over 500 sites in the UK and Ireland are now live and pushing digital innovation. AiT offers to integrate your live timetables into these new search and booking services as they become available in the UK.

IHRSA is known for its roundtables, as mentioned above, and keynotes. Soraya Darabi, a Young Global Leader of World Economic Forum said we can’t create emotional attachment if we stand for nothing. So Lyft drivers stand for great service, good value and working for a company they admire. From Soraya’s experience at her local gym in Brooklyn she wonders if the fitness industry, which has the potential, will ever develop the same emotional attachment. Martin Lindstrom, a brand futurist, suggested ‘living with the client’ or listening to the consumer because how many fitness sites have anything more than a feedback form? Lindstrom used the supermarket Lowes to show how it was ‘small data’ that helped turn around a failing brand, not big data. Lowes relaunch has some fun elements but Jonny Earle, alias Jonny Cupcakes was off the wall. He created a brand and inspired customer loyalty from shops that don’t sell cupcakes but t-shirts. My favourite was the breakfast t-shirt which you could only buy between 7-11am.

The 21st annual IHRSA financial panel moderated by Rick Caro emphasized that detailed knowledge of the industry is limited even when big investments are being made. l hope Rick will come to London in October for IHRSA Europe and put a panel of UK investors together who have access to the most detailed data on the industry thanks to LeisureDB. LeisureDB will be presenting in October its data analysis platform and the historical trends from its annual State of the UK Fitness Industry Report and live monitoring of the industry from its Social Media Fitness Index.

Historically prospectors in the Californian gold rush needed a shovel and a sieve, now influencers do the spade work for you. ‘Cycologists’ create 45 minute experiences you want to pay $30 for and who ignite avid followers. I’m following Shannon at Aura on Third, https://www.auraworkout.com and Nick at Cycle House on Melrose, http://cyclehousela.com...Who are you following?

- David Minton, Director of LeisureDB - IHRSA 2017

One Step Ahead

William Shakespeare famously said: “We know what we are, but know not what we may be”. Eloquently spoken personal trainers often recite this quote as their opening line – and I could make the same observation when asked, time and time again: “How big can the fitness industry grow?”

Like all business, timing is everything and this year we have seen more innovation than ever before. This has continued to drive the growth in the industry for the fourth year in a row; as detailed in the State of the Fitness Industry Report 2016 published by The Leisure Database Company. Highlights from the last year, include, the joint public and private penetration rate rising from 13.7% to 14.3%, the total number of fitness sites growing from 6,312 to 6,435 and the number of members jumping from 8.8m to 9.2m, the first time the industry has over 9m members. All of these contributing to the overall market value climbing from £4.3bn to £4.4bn in 2016.

Although, the disruptive business models of the so called ‘low cost’ brands are primarily responsible for driving the growth, it is not having an adverse effect on the overall value of the industry. Many brands have found the strength of the market allows them to charge above the publicity grabbing low-cost teens. These low cost brands are now responsible for around one third of all private fitness memberships. Whilst, the average monthly membership price has firmed from £18.23 in 2015 to £18.77 in 2016, reflecting the strength in latent demand for fitness across these sites. These first movers, which benefit from scale and new innovative in-house systems, which enable hour to hour and day to day management of the business, has allowed this sector to grow to over 450 sites with around 2m members in a very short period of time. The low cost sector saw a huge 41% increase in the number of clubs in the last twelve months and the clubs now have an average membership of 4,118. Immediate data science and enterprise security software are key to further growth.

In the six months since the publication of the 2016 Report, some major changes have taken place which are worth mentioning. Although Pure Gym, who have already opened another 17 clubs, remain at the top of the fitness operator leader board by number of sites (169), there’s a new number two. Following a buying spree, which included mostly Virgin Active clubs, Nuffield Fitness and Wellbeing Gyms have jumped from 5th to 2nd place with 112 clubs. They have gained 35 clubs and over 120,000 new members. Both, The Gym and David Lloyd Leisure, are in joint 4th spot; both have 82 sites and similar membership numbers. The franchise sector is having its best year so far; Anytime Fitness have opened 22 new clubs, taking their total to 91, Energie Fitness and their low cost brand Fit4Less have jumped to seventh place with 76 clubs and Snap Fitness has added 6 clubs to take them to 14.

Moving onto the public sector, there are 2,735 fitness sites, that collectively have over 3.3m fitness members and an estimated similar number on pay as you go. 41% are now managed by a trust.

For the third year running, the top three public operators by number of gyms remain with GLL, SLM and PfP. Freedom Leisure and Fusion are the only operators to move up the top 10 rankings in the last year, Fusion jumped to 4th and Freedom to 6th position.

For only the second time in 6 years, the number of closures across the public sector this year were higher than the number of openings. With 49 new gyms opening and 65 closing there was a net loss of 16 fitness sites. However, these sites were characterised as smaller gyms (24% less than the average), with fewer members, (27% less than average) and fewer facilities. So without investment they were never realistically going to compete.

In the past six months, we have also experienced the Pokemon Go fever, which overnight eclipsed social media platforms. The game achieved a higher number of daily users and longer time periods spent in the app than on WhatsApp, Instagram, Snapchat and Twitter. Whilst I’m sure it didn’t set out to make more people more active, in just a few weeks it did. Well it was fun while it lasted and the latest data shows the craze is waning, but there are lessons for the fitness industry, people will take part in more activity if it’s fun, engaging and different, rather than dreary and repetitive. Time to think outside the box!

It’s a fast changing world and social media remains a difficult area for fitness brands to achieve both followers and then quality engagement. Amongst the top 20 private brands, Facebook is the most popular platform, with the number of ‘likes’ at just over 1m. Twitter is in second place with just over 275,000 followers across the top brands. The highly engaging Instagram has only 68,000 followers and still only half of the top twenty brands have a presence, shame on you. Checkout who’s doing well with some great screen shot examples in the Social Media Fitness Index Q3 Report.

It’s no coincidence, that the top four active wear brands, Nike+ Running, Under Armour Record, Adidas Train & Run, and Puma’s Pumatrac are all building fitness communities through activity tracking. Fitness industry brands could grow as quickly if they took advantage of the opportunities to connect with their consumers through repeat check-ins for classes, challenges, guest passes and push notifications. One day, my personalised push notification will come.

David Minton - Health Club Management Handbook 2017, page 72.

The LISTED GYM SECTOR IS BULKING UP AGAIN

Last week an article was published in the Investors Chronicle discussing how 'The Listed Gym Sector is Bulking Up Again'. LeisureDB's statistics and David's insights were quoted.

"Between 2007 and 2011 the industry ticked along quite effectively, but with limited growth due to little innovation. It takes a while for new technology and innovation to have an impact on an industry. Smartphones have revolutionised the way consumers record their daily activity and check their health. The interest in tracking devices and wearable technology could help maintain general interest in fitness and be good for the industry.

The penetration of private health clubs (not under local authority control) has grown from 7.5 per cent to 9.1 per cent in the past four years and the joint public-private penetration is an impressive 14.3 per cent - an all-time high. Although we can point the finger to the rapidly expanding low-cost market for most of this growth, it is worth looking at the underlying technology that makes it possible.

Low-cost clubs are a hub of technology, relying on immediate data science and enterprise security software. Their presence on social media and ability to communicate digitally with customers is impressive and also allows for secondary spend across their mobile platforms.

Timing has played its part in bringing fresh technology, vision, innovation, interest and finance into an industry that we have always believed has enormous potential. Parts of it have been driven from 'data poor' to data-driven businesses and some consumers have turned themselves into walking, running, cycling, swimming and fitness data hubs.

The Gym's successful IPO in November 2015 reintroduced the fitness industry to the City and Pure is about to list, while we understand Bannatyne could also be seeking a flotation. US-based fitness and technology expert Bryan O'Rourke believes the global fitness market will grow by 300 per cent in the next decade. If this happens, it will mean great opportunities for UK brands."

David Minton, Director of The Leisure Database Company

Original article: Investors Chronicle, Bradley Gerrard - The Listed Gym Sector Is Bulking Up

Health & fitness industry to see 300% growth!

Via Health Club Management...

Byran O'Rourke believes the health and fitness industry is set for explosive growth over the next decade and could grow up to 300%.

Here are David Minton's thoughts on the industry's potential...

It's currently the most exciting time to be in the fitness industry in terms of innovation, growth and potential. Three hundred per cent growth is definitely possible: the industry needs to think BIG. Globally we should be aiming for half a billion members.

Penetration rates are very low in the global fitness industry at present - still in the low single figures in lots of countries - so the potential is enormous, especially in Asia and the developing world. However, there's still huge potential for the market in the UK too, which has grown by two million members since 2007 to achieve 14.3 per cent population penetration.

Two factors will drive growth: education and experience. Operators need to focus on improving both. Following the lead of the hotel industry, they need to keep investing in the product and innovating.

They also need to get better at using data to connect with current and potential members. Although we're definitely seeing improvements, historically the industry has been poor at finding out how often members come, what they do and what they spend.

Change will happen across all ages and demographics. However, certainly in the UK I don't see a huge growth coming from the healthcare sector at the moment because, to engage with the NHS, the industry will need to become far more professional, start talking the same language and take part in clinical trials.

PRESS RELEASE: Social Media Fitness Index Q2 2016 Report

PRESS RELEASE - SOCIAL MEDIA FITNESS INDEX Q2 2016 REPORT

1st August 2016

993k Facebook likes, 55k Instagram followers, 262k Twitter followers, 10.6k YouTube subscribers*

Xercise4Less ranks 1st in social media stakes

One brand tops three social media platform rankings

*Across the top 20 private brands in Q2 2016

LeisureDB’s Social Media Fitness Index Q2 2016 report reveals that low cost private brands continue to be excelling on social media. Xercise4Less have topped the overall ranking this quarter ahead of second placed Pure Gym.

Following a storming performance in Q2 2016, Xercise4Less have overtaken all other brands in 3 of the 4 social media platforms. Meanwhile, 7 of the top 15 fitness brands have dropped between 1-10% in the overall scoring.

Despite the number of likes, followers, subscribers and views across all channels growing in Q2 2016 from Q1, there has still been less activity and engagement. Could this be a result of more social media activity taking place during the new year fitness boom? And why are brands still failing to provoke responses to their posts?

Commenting on the report findings, David Minton, Director of LeisureDB said: “Fitness industry brands could grow quickly if they took advantage of the opportunities to connect with the consumers…We will be looking out for improvements in Q3 2016”.

Notes:

The reporting period is the 3 months from 1st April 2016 to 30th June 2016. LeisureDB who has been monitoring performance of the fitness industry for over 30 years compiled the analysis and resulting figures.

Further Information:

LeisureDB is a leading independent database specialist who provides key market intelligence and analysis across the industry. Established over 30 years ago, the company works with a wide range of fitness operators providing customer profiling reports, new site analysis and latent demand estimates. 2016 sees the launch of 2 new services: LeisureDB Mobile Apps and the LeisureDB Social Media Fitness Index.

Tel: 020 3735 8491

Nuffield Health acquires 35 Virgin Active sites...

It was announced via Health Club Management yesterday that Nuffield Health have acquired 35 Virgin Active sites and here are David Minton's thoughts....

"Nuffield, as one of the largest trusts in the country, are the only brand perfectly placed to link wellness, hospitals, corporate and fitness sites. It's great to see them growing their estate via former Cannons, Esporta and Virgin Active sites".

Virgin Active have announced they will remain a significant player in the UK despite selling the clubs.

60 Second UK Fitness News - 10th June 2016

In this weeks 60 Second News: Leisure Management reported this week that on the 25th June Barry’s Bootcamp will be taking over the London Eye. The boutique chain which has two sites in London will deliver 15 classes simultaneously in 15 pods on the London Eye. It costs £60 to take part and all proceeds will go to Stand Up To Cancer.

Last weekend saw the opening of Thorncliffe Health and Leisure Centre in Sheffield, which is managed by Places for People. The centre boasts two pools, a gym and two studios and was built to replace Chapeltown Baths.

This week has also seen two new openings from the Anytime Fitness franchise in Corby and Luton.

Lastly, Blink Fitness in America has decided to cover all their mirrors for the month of June. The mirrors have been replaced with signs saying ‘Do it for the mood, not just the mirror’. The aim of the campaign is to remind members exercise is about more than just looks. BlinkFitness Vice president, Ellen Rogemann, is hoping the brand can provide an antidote to the ‘beach body ready’ message. Let us know what you think of this idea by sending a tweet to @TLDC_UK.

Thanks for watching!

Press Release: Social Media Fitness Index Q1 2016

SOCIAL MEDIA FITNESS INDEX Q1 2016 REPORT

3rd June 2016

946k Facebook likes, 46k Instagram followers, 248k Twitter followers, 9.3k YouTube subscribers*

Pure Gym ranks 1st in social media stakes

One brand tops two social media platform rankings

*Across the top 20 private brands in Q1 2016

The brand new LeisureDB Social Media Fitness Index Q1 2016 report reveals that low cost private brands are excelling on social media, with two big names of the industry dominating the top places.

The Q1 2016 report highlights that overall brand social media presence is growing. Over half of the top 20 private brands gained 1,000+ Facebook likes in Q1 2016 whilst the collective Twitter audience grew 6%.

Whilst some brands are digitally aware, there’s plenty of room for improvement. There needs to be more posts, more interaction and higher engagement.

Facebook is the most common social media platform among the top 20 private brands whilst Instagram is being under-utilised and neglected; only 8 of the top 20 have accounts.

Commenting on the report findings, David Minton, Director of LeisureDB said: “Sport and fitness have a lot of catching up to do. The industry has 9.2million UK fitness members but across the top 20 private fitness brands it can only boast 946k likes on Facebook, 46k followers on Instagram and 248k followers on Twitter. As a benchmark, this first report is a great snapshot of the private fitness industry’s top 20 social media activity in Q1 2016”.

Notes:

The reporting period is the 3 months from 1st January 2016 to 31st March 2016. The Leisure Database Company who has been monitoring performance of the fitness industry for over 30 years compiled the analysis and resulting figures.

Further Information:

LeisureDB is a leading independent database specialist who provides key market intelligence and analysis across the industry. Established over 30 years ago, the company works with a wide range of fitness operators providing customer profiling reports, new site analysis and latent demand estimates.

60 Seconds UK Fitness News - 3rd June 2016

In this weeks 60 Second News; today sees the launch of our first ever LeisureDB Social Media Fitness Index. The report covers quarter 1 of 2016 and compares the UK's top 20 private fitness brands and ranks them based on their performance on Facebook, Twitter, Instagram and YouTube. You can download your copy of the report from our website now for £195 + VAT.

SLM or Everyone Active as they’re better known was announced this week as the new management of Westminster Sports Centre from the 1st July 2016. The 10 year contract will see SLM manage 8 leisure centres.

Frome Sports and Fitness Centre, which is managed by Fusion, opened its doors on Wednesday following their £2million refurbishment. The centre boasts new gym equipment, a large soft play area, new classes in their two new studios and a dedicated cycling studio.

Lastly, we would just like to say congratulations to The Gym Group who have been awarded the Investors in People Gold Accreditation, which is currently achieved by just 7% of organisations.

Thanks for watching!