The future will be all about data...

As an estimated 80 per cent of CV equipment will be able to link up to Apple’s GymKit within a few years, the future will be all about data. Rather than threaten the role of the PT on the gym floor, I think data driven equipment will have the opposite effect and people will need more help, advice and reassurance on how to interpret it most efficiently. And, just as the car industry is having to adapt to the presence of electric cars, the fitness industry will also adapt. It will be more software than equipment led. With Apple, the largest tech company in the world, moving into our space and making it a data game, people’s perceptions of exercise will change. The gym is likely to be incorporated into everyday wellness habits like walking and climbing stairs. Data will give PTs the opportunity to get more involved with their clients between sessions, give personal push notifications, see what their clients are doing when not at the gym and praise them. This innovation will also involve more people from different levels of society, as one of the reasons why lower income groups don’t engage is because they often don’t know where to start. Operators will be forced to adapt, because their clients will adapt, but they should embrace the change.

David Minton

Original Source: Health Club Management - issue January 2018, pg. 37

December: Gym Owner Monthly

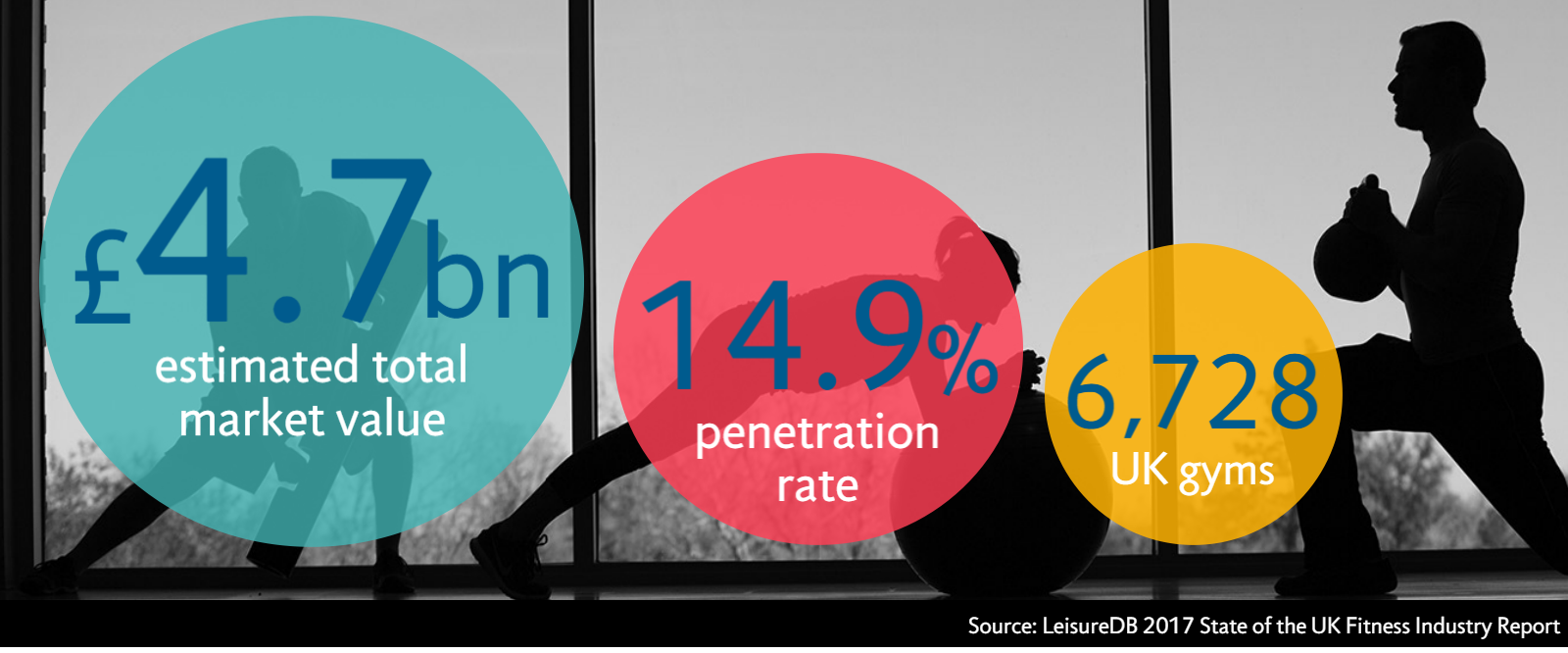

UK FITNESS MARKET

The total UK fitness market has just over 6,700 gyms and an overall penetration rate of 14.9%. England, the largest and most populous country, is home to most of the UK’s gyms; it also has the highest penetration rate (15.3%). Northern Ireland, Scotland and Wales all have penetration rates over 10%. How much growth will the industry see in 2018?

Original Source: Gym Owner Monthly

How to fatten your profits as the world slims

Article in MoneyWeek by Alice Gråhns

Modern living has turned us into overweight, inactive couch potatoes. There’s an app for that, says Alice Gråhns – and an opportunity to profit for smart investors.

Once upon a time, hard, regular physical exercise was part and parcel of our daily existence, rather than an optional extra we fitted in in our spare time. From ancient times until really fairly recently, our ancestors didn’t need expensive gym facilities to stay in shape. From hunter-gathers to farm labourers to industrial workers, a combination of physically demanding manual work, walking rather than driving, and a daily calorie intake restricted by necessity rather than choice, kept us active (if not always healthy). It’s little surprise that many of us struggle to keep fit in the modern era of sedentary jobs, widespread car ownership, and virtually limitless opportunities to snack.

This has created a burgeoning boom in businesses dedicated to keeping us healthy. In 2006, 13% of adults in England took part in regular fitness activities. By last year, this had risen to 16%. Today, one in every seven people in the UK is a member of a gym, and ever more are signing up. In the year to the end of March 2017, overall UK gym membership numbers grew by 5.1% (6.3% in terms of value), according to the 2017 State of the UK Fitness Industry Report by health and fitness consultancy LeisureDB. Meanwhile, the sector has grown globally from being worth $67bn in 2009 to $83bn last year. And it’s not just about going to the gym. Every aspect of the fitness industry – from sports centres to healthy foods to tracking technology and even “activewear” – is expanding rapidly. People don’t just care about what they do with their bodies, but also about what they put in them and on them.

Indeed, says David Minton, founder of LeisureDB, the industry is entering a golden age. Individuals are increasingly aware of the need to look after themselves, helped both by public health campaigns and (in the UK) the ongoing post-2012 Olympics “halo” effect. Meanwhile, fitness facilities are ever more widespread and of higher quality, customer service is improving, and gym membership is becoming more affordable, says Steven Ward, chief executive at UK Active. While the 16- to 34-year-old demographic is the key target market (young consumers generally are), the older generation is also increasingly interested in getting into shape.

Then there’s the expanding role the government sees for the industry. We wrote about the obesity epidemic a few months ago in MoneyWeek, but increasingly there’s a new public health enemy number one – inactivity. Physical inactivity is the largest cause of premature mortality globally, according to the World Health Organisation. Nearly 13 million people in the UK are classed as physically inactive, meaning they fail to rack up at least 30 minutes of physical activity per week. The fitness industry can only benefit from government efforts to tackle that. Indeed, all of those inactive adults represent a significant growth opportunity.

Big health is big business

As demand has grown, the range of options for keeping fit has widened considerably. These days, in most British cities, you’ll see a fitness centre on every other street corner – be it a low-cost gym, a boutique gym or an expensive health club with fancier facilities. Much of the industry’s growth is arising at the budget end of the market. There are now more than 500 low-cost clubs (defined as those charging less than £20 a month), accounting for 15% of the market value and more than a third of total membership. Beyond offering keen pricing, budget chains attract customers by offering 24-hour access (so you can work out around your working day) and freedom from annual contracts.

These budget gyms often appeal to first-timers who, as they become fitter, may work their way up the market, says Minton. Boutique gyms are smaller and more exclusive than low-cost gyms, and tend to focus on one specific area of fitness. Alternatively, health clubs are larger and more anonymous, but usually have the most extensive facilities, with spas and swimming pools. But whatever the entry level, the two key staples of the fitness industry are gym sessions (people working out individually) and fitness classes (exercising as a group), says Lisa O’Keefe, director of insight at Sport England. Almost 4.5 million people do gym sessions regularly and 1.6 million people take fitness classes. Men generally tend to stick to weightlifting, while women typically favour group workouts, says O’Keefe. This is a trend that has become more apparent fairly recently, helped partly by the high profile of female athletes at the London Olympics in 2012.

The industry itself – not unlike the fashion business – is very good at creating and responding to demand, generating an ongoing stream of new classes to capture fickle consumers’ imaginations. A couple of years ago, Zumba was the “in” exercise. Today, CrossFit, yoga and innovative spinning (cycling on the spot) classes have taken over. Even nightclubs have joined in – they provide exercise classes during the day and put the gym equipment away for the night.

It’s about what you eat too

Interest in healthy eating is booming too. And you don’t have to be an ardent gym bunny to care about watching what you eat. For example, the UK market for organic food is now worth nearly £2.1bn, and is growing strongly – total sales of organic food grew by 7.1% last year, according to the Soil Association, while non-organic sales fell. A growing number of companies now provide healthy meal and nutrition plans delivered direct to your door.

However, above and beyond those who desire a more healthy diet, there’s a growing appetite for supplements and specialist foods aimed specifically at gym fanatics, bodybuilders, professional athletes and enthusiastic amateurs: everything from so-called “superfoods” packed with vitamins and antioxidants to protein shakes. It’s fair to say that the scientific benefits of many of these supplements are the subject of debate and others are simply soft drinks repackaged as “lifestyle” brands. Yet demand for these products is growing just as, if not more, rapidly than the market for organic food. The global sports nutrition market is already worth nearly $30bn and it’s expected to grow at an annual rate of around 8.1% for the next five years, to reach a value of $45.27bn by 2022.

The rise of “athleisure”

The growing cult of the body – with everyone from celebrities to fitness bloggers to “ordinary” people given to posting snapshots of their “rock-hard abs” on social media – has also fuelled a desire to look good in workout gear. Scruffy tracksuit bottoms won’t cut it in your high-end boutique gym, leading to a rapidly growing market for athletic products and apparel. Increasingly that trend is spilling out into the high street. Sportswear is not just for exercise. Indeed, many people who wouldn’t go to the gym if you paid them will nevertheless snap up expensive “athleisure” gear. According to GlobalData, growth in the sportswear sector is set to outpace the total UK clothing market this year, which itself is expected to grow by 2.1%.

Indeed, the fashion trend is so popular that many wonder how long its vertiginous rise can be sustained. However, investors can relax – even if UK consumers start to find new fashions, the global trend remains robust, driven partly by growth in China. In fact, global athletic wear sales are expected to increase by nearly 20% by 2021, to $355bn from $290bn currently, according to analysts at Morgan Stanley. This can be attributed to the increasing number of luxury fashion designers turning their eye to sportswear. Stella McCartney designed the Team GB kit for the 2012 Olympics, and since then both Chanel and Dior have released couture trainers, while Alexander Wang launched an athletics range for H&M. The activewear trend has, of course, also boosted sports brands such as Nike and Adidas.

A robotic nag

Another growing obsession – both in terms of physical health and the wider self-help movement – is the drive for relentless self-improvement via the formation of healthy habits. This usually involves keeping some sort of record of your activities, which in turn has increased demand for devices that can track what you do – and nag you gently (or not so gently) when you fail to achieve your daily targets.

The chances are that you already have such a device – or at the very least, your smartphone has the capability to act as a fitness tracker if you download the right app. Technology is disrupting most businesses on the planet and the fitness industry is no exception. Wearable devices – from phones to smartwatches to simple wristbands – mean that you can now easily track how far you’ve run, what speed you’ve been going at, and how many calories you’ve burned. And a few days after your run, you’ll get an electronic reminder that you found 7.30pm on Tuesday evening to be a convenient time for a workout – don’t you think that now is the ideal time for another one?

This ability to track our progress and to adjust our exercise patterns accordingly has in turn fuelled even more demand for yet more data and analysis. As a result, the global wearables sector is expected to rocket in value from $23bn last year to $173bn in 2020, according to global analyst MarketsandMarkets.

The disruption caused by technology in the fitness industry isn’t all about wearable technology. The software at the back-end of a fitness centre is just as important – whether it be a booking system, a management tool for members’ access to the facility, or an automated sales system. In the future, these customer-relationship management (CRM) systems will undergo major changes as artificial intelligence becomes increasingly popular, reckons Minton.

The goal of any fitness services provider is ultimately to make the process more seamless – the fewer hurdles there are between a customer joining the gym and following through on their good intentions to use it, the more profitable the gym is likely to be. Artificial intelligence will help to personalise membership for each customer – your gym’s software will learn what type of activity you like, and send personalised “push notifications”, informing you of upcoming classes you might enjoy and offering to book you in for a session. Just as wearables already know your preferences, so your local gym will too.

The five best stocks to buy now

If you want to invest in the growth of the fitness market, US-based Planet Fitness (NYSE: PLNT) is one of the largest and fastest-growing gym chains in the world, with around seven million members. The company’s quarterly revenue has climbed 12.1% year over year to $97.5m, but unfortunately, that rapid growth appears to be thoroughly priced in after the share price surged following the strong results – it now trades on a steep price/earnings (p/e) ratio of 45. An alternative UK-based option is the low-cost fitness chain The Gym Group (LSE: GYM). The company has 95 gyms in the UK and plans to open another 20. It’s growing fast too – it saw revenue rise by 18.8% to £42.8m in the six months to June 30 – but trades on a slightly less eye-watering forward p/e of below 30, which is just about reasonable (though still not cheap) given the growth rate.

On the dieting side, there are several big US firms that produce diet plans and low-calorie foods, including Weight Watchers and Medifast. Ever so slightly cheaper than either of those – on a forward p/e of around 25 – is Nutrisystem (Nasdaq: NTRI). Brokers are targeting an average price of around $70 a share for the stock, compared with its current level of just below $50. Another option you may be considering is supplements provider Herbalife, given its p/e of 14. However, we’d be wary of this one – Herbalife is a consistent short-selling target, and while it has thwarted the shorts so far (notably hedge-fund manager Bill Ackman), we wouldn’t risk investing without doing detailed due diligence first.

A key brand to keep an eye on in the activewear sector is Adidas (Frankfurt: ADS). In North America, sales jumped 31% in the last quarter, topping $1bn in the region at a time when Adidas’s two biggest rivals, Nike and Under Armour, have struggled to keep sales up on their home turf. On a p/e of 28, it’s not cheap, but of the big brands it currently looks the best option. A less obvious bet is Lululemon Athletica (Nasdaq: LULU). The upmarket yoga and fitness gear company has struggled amid concerns over potential competition from Amazon and Nike, but continues to expand both internationally and in other areas, such as men’s clothing.

On the tech side, one option is Mindbody (Nasdaq: MB). This $1.5bn firm provides cloud-based business-management software and payment systems for “the wellness services industry”, and offers an app designed to help users find and book exercise classes. It doesn’t yet make a profit, so it’s risky, but revenues are growing fast.

Free fitness classes in shops are the new trend

Original Article: Independent.IE

If you’re heading to London for Christmas shopping, there are a few ways to preemptively offset the effects of the Christmas pudding.

In the city of the Thames, sportswear brands like Lululemon, Reebok and Nike are offering free classes to their customers.

Lululemon provides a free yoga or fitness class on Sunday mornings in its Marylebone store in London, for example. Yoga mats are provided.

In Reebok’s Fit Hub in Covent Garden, it offers free evening classes like 'Gymbox’s Badass', 'Hardcore HIIT', and 'Contortion Yoga'.

These brands are expanding their focus and building relationships with their consumer, David Minton, a keynote speaker at tomorrow’s Ireland Active conference, told independent.ie.

"Some of the big brands are getting into fitness and offering it free of charge - people like Nike who are offering free runs. In Reebok, you can join one of their classes in the Fit Hub. Lululemon are offering free classes in their shops and they create studios in their shops. Sweaty Betty is a London brand and are offering free classes," he said.

"This is a new area where the brand is looking to create more of a relationship with the consumer."

How is this impacting the health and fitness industry, Minton asks.

"We don’t know yet because they’re trying to build a direct relationship with the consumer, not just sell them a kit."

According to Minton, the free classes aren’t just getting a big take-up. It’s also the boutique-style, higher end shops and gyms that are going from strength to strength.

"The biggest trend is in boutiques. I’m aware of the advertising that people like Ben Dunne do and how people are trying to provide lots of things for very little money. In London, we’re now going to the opposite extreme, low cost is amazingly successful, for people who are paying below 20 pounds per month. Now just imagine if people are paying 20 pounds per session or more," he said.

"There are new boutiques that are all expanding in the UK.

"They provide night club lighting, night club sound, better look facilities, and top instructors, and you feel you’ve had a top experience.

"Maybe some people are not having the Starbucks and instead having the experience."

November: Gym Owner Monthly

UK Fitness Members

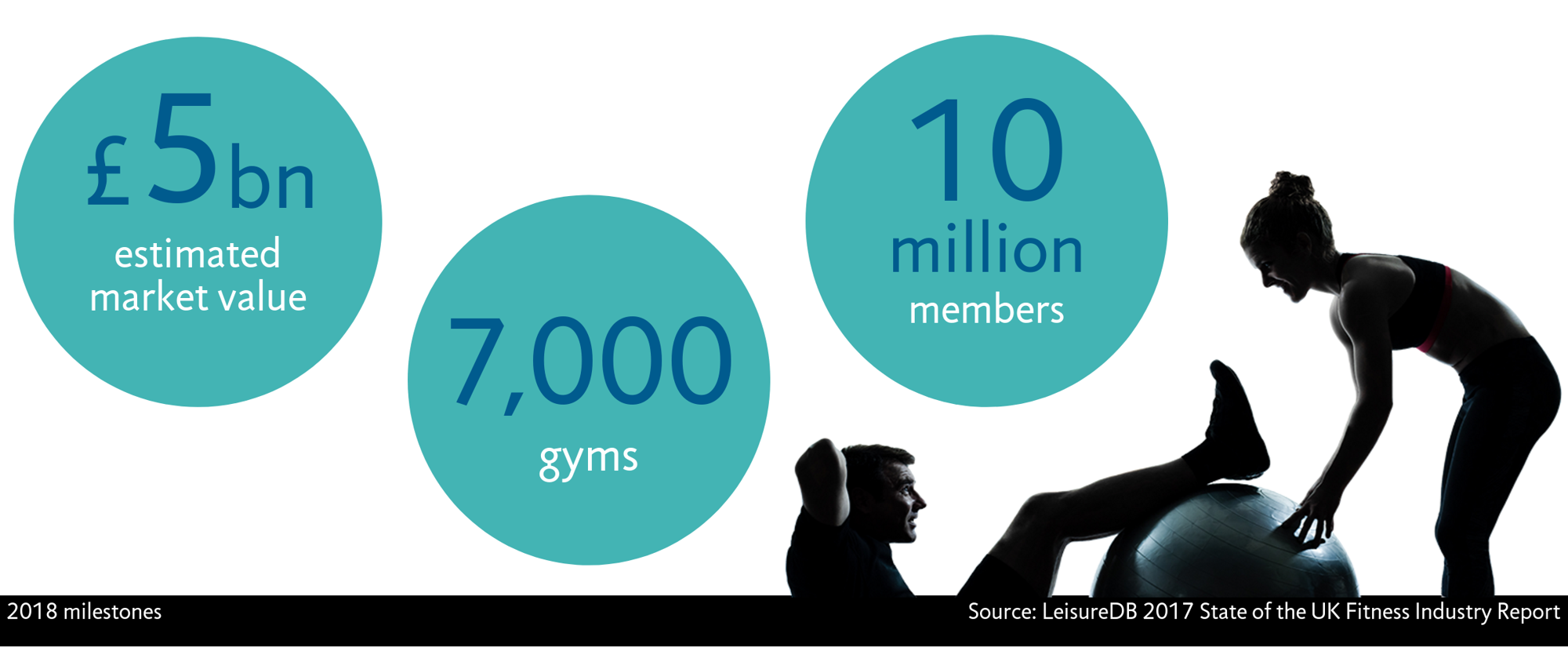

The 2017 State of the UK Fitness Industry Report states that membership within the UK gym sector is growing. In 2015, the total number of fitness members was 8.8 million which increased to 9.7 million in 2017. For the first time in 2016, the total number of fitness members exceeded 9 million. Will 2018 be the year that membership surpasses 10 million?

Original Source: Gym Owner Monthly

IHRSA European Congress, London

David presented at the IHRSA European Congress on Wednesday. His presentation looked at the state of the European fitness markets, particularly within the UK. He also led a tour group around 3 Central London clubs; Third Space Soho, EasyGym Oxford Street and the Oasis Sports Centre, Covent Garden.

Here are some infographics used in his presentation...

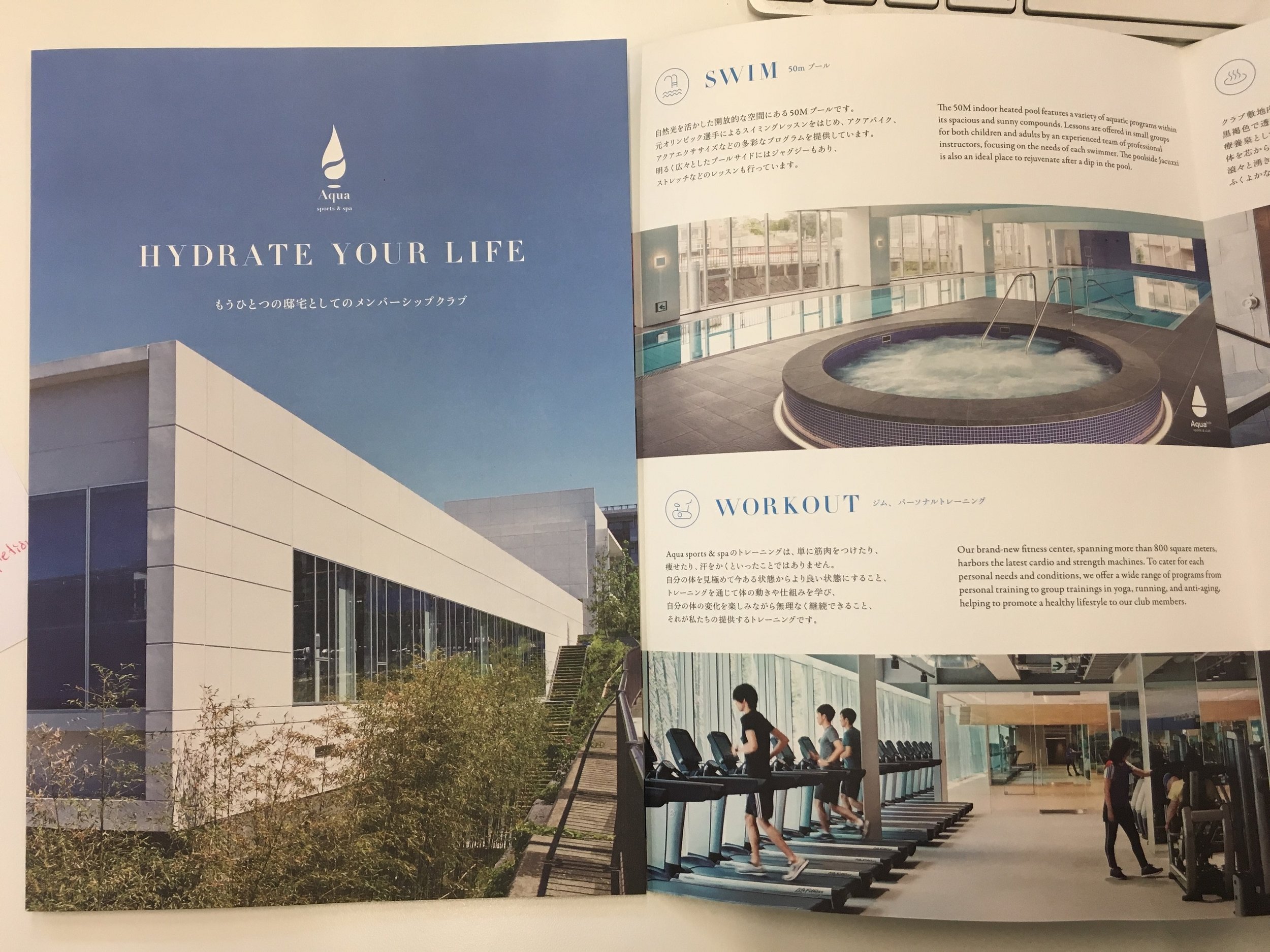

Fitness Industry in Tokyo, Japan

David visited Tokyo last week to attend a number of Japanese fitness industry events.

He met with the President of Sasakawa Sports Foundation for the release of their white paper on "Sport in Japan 2017". He presented to the Fitness Industry Association of Japan and the Waseda University.

He also visited a number of health clubs. boutique studios and gyms including Aqua Sports & Spa, Deportare Club, R-Fitness, B-Monster Boxing and Anytime Fitness.

Japan & IHRSA 2017

David will be presenting his thoughts on the UK Fitness Industry in Tokyo, Japan this week. On his return to London, David will be speaking at the opening of the 2017 IHRSA European Congress.

His agenda is as follows:

- 13th October > Meeting with the Japan Sports Agency & presenting at the Waseda University

- 16th October > Meeting with the Development Bank of Japan

- 17th October > Presenting to Sasakawa Sports Foundation

- 18th October > Presenting to Sasakawa Sports Foundation

- 20th October > Presenting to the Fitness Industry Association of Japan

- 23rd October > Presenting at the IHRSA European Congress in London

IHRSA Opening Keynote - The State of the UK Fitness Market lead by David Minton...

The UK is unique in auditing the fitness industry in granular detail each year. The Leisure Database Company has developed a consistent methodology for the industry and built a database now used by operators, suppliers and financiers to the industry. You will receive highlights from the annual State of the UK Fitness Industry Report, which includes trend analysis, growth in number of gyms, members, value of the industry and the penetration rate, which reached 14.9% in 2017. David believes the UK is beginning the golden age of fitness and will share his projections of growth leading to 2020.

Manpo-kei

The Tokyo Olympics in 1964 made history by being the first to be telecast internationally and popular sports, including judo and sumo wrestling, were broadcast in colour. Public interest in the Games also created a lasting legacy which organisations around the world have adopted and keep adopting today.

To paraphrase Neil Armstrong on the Apollo 11 moon landing, that’s 10,000 steps for mankind and one giant step for a healthier society.

Published findings found that the average Japanese person took between 3,500 to 5,000 steps per day. A Japanese research team lead by Dr Yoshiro Hatano capitalised on these findings and the nations interest in sports. The team recognised that if this could be increased to 10,000 steps a day, people would become healthier. And so, Dr Hatano began selling a 10,000-step pedometer known as ‘manpo-kei’ (10,000 step meter) and this arbitrary number quickly grew into the ideal daily number to aim for. Japan’s Ministry of Health still recommends a daily walk of 8,000 to 10,000 steps.

Fifty years later the UK National Obesity Forum, which says the average Briton walks about 3,000 -4,000 steps a day, suggests we should aim for between 7,000 and 10,000. The National Health Service (NHS) is promoting “Walking for Health” as it is simple, free and one of the easiest ways to get more active, lose weight and become healthier. In London, the NHS is working with Transport for London (TfL) to encourage walking as part of your journey to work, walking to the shops, using the stairs instead of the lift, leaving the car behind for short journeys. Both organisations are encouraging people to use apps to track how much and how fast you’ve walked. TfL have produced maps showing walking times between stations to encourage a variety of walks including parks, trails, towpaths and nature reserves. My local favourite is from Paddington, which is Zone One to Warwick Avenue, one stop on the Bakerloo Line but in Zone 2. The walk goes along the canal, past the Robert Browning Island in Little Venice, where the Regent’s canal and Grand Union Canal meet. You save money and have a car free walk.

Promotion of walking groups and inspiring walks are growing in popularity along with the more established Ramblers organisation, Britain’s walking charity also promoting walking for health. The UKs National Parks run free guided walks for the whole family during holidays. Walkit, Active 10, Hikideas are just a few of the apps you can download that can suggest routes, journey time, calorie burn, step count and carbon saving.

The technology for a pedometer has changed over the past 50 years with the so called wearable market growing from nothing in the mid-sixties to an estimated $26 billion by 2019 and an estimated 245 million wearable devices being sold next year. Smart watches are now the most valuable segment, taking 60% of market value but fitness trackers remain most popular, accounting for more than half of all wearable shipments in 2016. Smart phones and watches have been tracking our every move and that data usually goes into an app so you can see the results. Most of the apps also allow you to load workout data from other activities and wearables into your phone activity app so it’s all in one place. The iPhone 5 was the first phone to contain a motion coprocessor, developed by the UK’s most successful technology company ARM Technologies, based in Cambridge, recently sold to Japanese SoftBank for £24 billion. ARM technology is used in over 90% of all smart phones worldwide. With the release of the iPhone 6 Apple Health was introduced to present activity data back to its owner via an app on every Apple phone.

Most governments’ guidelines and health agencies plus organisations such as the World Health Organisation (WHO), US Centre for Disease Control (CDC), US Surgeon General, American Heat Foundation, US Department of Health and Human Services recommend daily activity of 10,000 steps. A study published in the Journal of The American Medical Association concluded that use of a pedometer (or a tracking device) is associated with significant increase in physical activity and decreases in body mass index and blood pressure.

At Tokyo 2020 we will all be busy urban adventurers and 10,000 steps a day will be easily completed going from one event to another. It will be a fitting tribute to Dr Hatano that so many people will be doing 10,000 steps in his city 50 plus years after he invented the basic metric to good health.

By David Minton, Director of LeisureDB & Correspondent for SSF in London

Original Article: Sasakawa Sports Foundation

October: Gym Owner Monthly

Public Sector

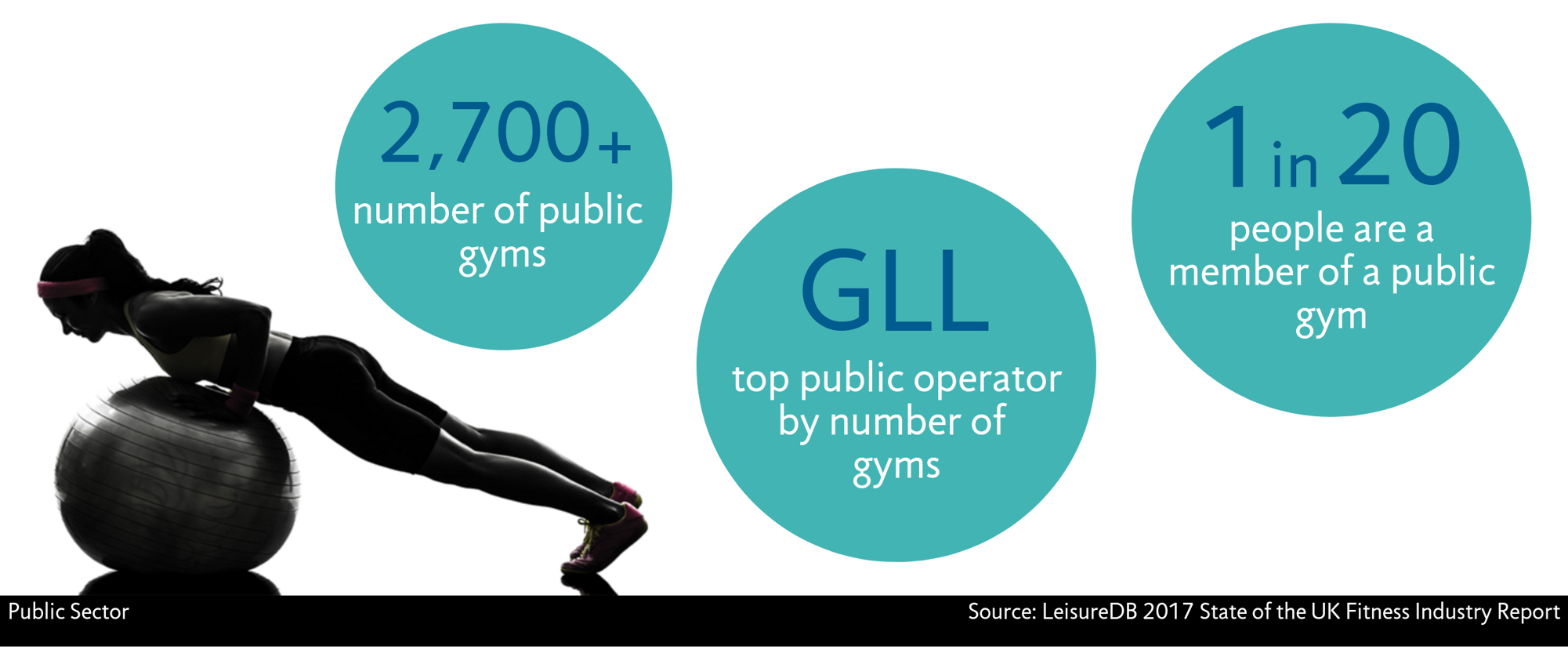

The 2017 State of the UK Fitness Industry Report reveals that 1 in every 20 people are members of a public gym. The public sector has over 2,700 gyms across the UK and Greenwich Leisure Limited (GLL) is the top operator. For the first time in five years, the public sector has seen a slight decline in membership numbers. Is this due to a combination of operating budgets being reduced and the impact of the private low cost market?

Original Source: Gym Owner Monthly

September: Gym Owner Monthly

2018 Milestones

The 2017 State of the UK Fitness Industry Report revealed that the UK health and fitness industry is continuing to grow. David Minton, Director of LeisureDB said: “It may be premature to call the period to 2020 “the golden age of fitness” but further growth will only be limited to the imagination of those pushing the boundaries. The signs are there that the industry is likely to hit several milestones in 2018. The number of gyms is on course to go over 7,000 for the first time, total membership to exceed 10 million and market value to reach £5 billion”.

Original Source: Gym Owner Monthly

The English Season

There is no better time to watch sport in England than the summer months. The unique collection of sporting events is known as the ‘season’ and runs from May to August each year. Many of these sporting/social events evolved in the 17th and 18th centuries by the landowning aristocratic and gentry families to affirm their privilege and social superiority. The social elite lived, for the most part, on their country estates but spent the summer in London to socialise, play and watch sport. It was also an opportunity to mix with royalty, as most events had, and still has, royal patronage.

The Sports season remains heavily biased towards equestrianism. Royal Ascot, founded in 1711 by Queen Anne, is still owned by the Crown Estate. The Queen arrives each day during Ascot Week, with members of the Royal Family, along the track in horse drawn landaus. Fashion is a huge part of Ascot culture, particularly the impressive and over-the-top hats worn by the ladies.

The Derby is the richest horse race in Britain and the most prestigious of the five classics and was first run in 1780. The Epsom Downs Racecourse in Surrey brings rich and poor together and to this day crowds need not pay a penny to watch the race and all can enjoy the race and funfair from the Downs. This famous flat horse race, over a distance of one mile, four furlongs and 6 yards (2,420 metres) is on the first Saturday of June each year. It has inspired many similar events around the world including the Tokyo Yushun.

The Grand National first ran in 1839 over the National Course which includes 16 fences, at Aintree Racecourse near Liverpool. It is now estimated that up to 600 million people in over 140 countries, including Japan, watch this most valuable jump race in Europe.

Tennis started at the All England Lawn Tennis Club (AELTC), home to Wimbledon, in 1877 and it’s estimated that over 1 billion people watch Wimbledon worldwide. There’s only 375 Full Members of AELTC which is based on the number of seats in the original stand. Around 70 honorary memberships are held by past singles championship winners.

The world’s first multipurpose sports complex to be built in 1886 was The Queens Club in Hammersmith. It still has 27 outdoor lawn tennis courts, 2 Real Tennis courts and organises one of the pre-Wimbledon competitions each June.

The Lords Test Match takes place at the Marylebone Cricket Club (MCC) which was founded in 1787. There are 18,000 full members and 5,000 associate members of the MCC who collectively own the ground and the Ashes. The term ‘ashes’ was first used after England lost to Australia on home soil in 1882. The MCC members wear the famous red and gold striped jacket and tie, affectionately referred to as ‘egg and bacon.’ The waiting list to become a full MCC member is 27 years.

The Boat Race, on the River Thames, between Oxford and Cambridge Universities, began in 1829 and takes place each year with an estimated 250,000 spectators watching from the riverside and bridges. The spirit of competition is so strong between the teams that Olympic standard rowers often compete. Sir Mathew Pinsent, who rowed for Oxford in 1990, ’91 and ’93 went on to win 10 world championship gold medals and four Olympic gold medals.

Outside London on the Isle of Wight, Cowes Week which began in 1826 and is run by one of the most prestigious and exclusive yacht clubs in the world. The Royal Yacht Squadron which was started in 1815 by 42 original members who agreed to meet every three months for dinner. 200 year’s later membership has grown to just 450, there’s no waiting list, you wait to be invited. 1,000 boats in up to forty different handicap multihull classes race every day for eight days. It’s the mixture of classic, including several boats that raced more than 50 years ago, plus ultra-modern designs, that gives the regatta its uniqueness. Around a third, of the 8,000 competitors, are women and the range is from Olympic and world class to weekend sailors. Traditional seafaring members can also be found at the Royal Thames Yacht Club, founded in 1775 it is the oldest continuously operating yacht club in the world with its prestigious club house in Knightsbridge overlooking Hyde Park.

The most colourful water event is Henley Royal Regatta, the undisputed home of British Rowing and rich pageantry. First held in 1839. Rowing crews and former oarsmen wear handmade blazers in the colours, stripes and monogram of their team all topped off with a straw boater for men and a silk item for ladies. There’s a ten year wait to become a full member.

Dress codes apply to all events, particularly where the Queen plays an official role and if you have access to the Royal Enclosures, Member Areas, or Stewards Enclosure. At Royal Ascot, (pronounced Ascut), in the Royal Enclosure, gentlemen are required to wear either black or grey morning dress including a waistcoat with top hat. At Henley in the Steward’s Enclosure gentlemen must wear a jacket and tie and rowing club colours on a blazer or cap are de rigueur. Besides the dress code most events also insist on enamel style lapel badges and tags to comply with the traditional expectations of an Edwardian period garden party.

Between the sports wider arts and horticulture events began including; the Proms at the Royal Albert Hall in 1895, the Chelsea Flower Show, organised by the Royal Horticultural Society in 1804 and the Royal Academy Summer Exhibition, 1768. The Trooping of the Colour, one of the oldest seasonal events began in 1748. Many newer events have become firm favourites of the ‘season’ including opera in the country, like Glyndebourne and in London at Holland Park, Kensington. Polo on Smiths Lawn, Windsor, home to the Guards Polo Club the largest in Europe in terms of members and grounds. Badminton Horse Trials started in 1949 against the backdrop of the Dukedom that was created in 1682 and the 17th century Badminton House. The Royal Windsor Horse Show, first started in 1943 is now the only show in the UK to host international competition in show jumping, dressage, carriage driving, endurance and showing.

This year the ‘season’ has also had a sell-out exhibition at the British Museum, Hokusai, Beyond the Great Wave. Katsushika Hokusai (1760-1849 is one of Japan’s most famous artists and this exhibition takes you on a journey through the last 30 years of Hokusai’s life. A time when many of the English ‘season’ events were just starting.

David Minton

For SSF - July 2017

August: Gym Owner Monthly

The private low cost market

The 2017 State of the UK Fitness Industry Report reveals that the UK health and fitness industry is continuing to grow. This growth is being primarily driven from the private sector, which has more clubs, more members and a greater market value than ever before.

The low cost market has continued to be the main driving force behind the private sector growth. There are now over 500 low cost clubs which account for 15% of the market value and 35% of membership in the private sector. The UK’s leading low cost operator is Pure Gym with over 180 gyms.

Original Source: Gym Owner Monthly

July: Health Club Management

World of Fitness

In the July Issue of Health Club Management, the IHRSA 2017 Global Report findings were published including statistics from the LeisureDB 2017 State of the UK Fitness Industry Report...

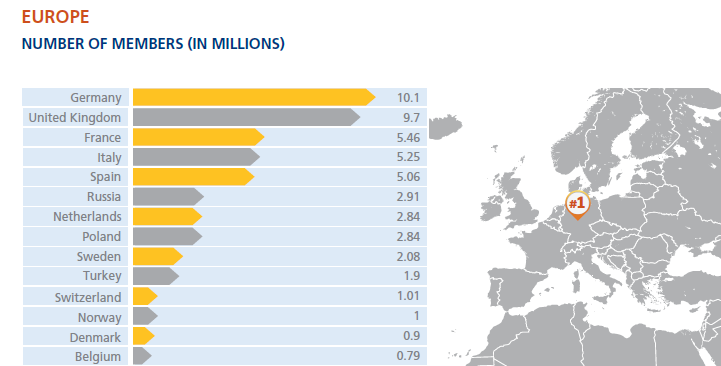

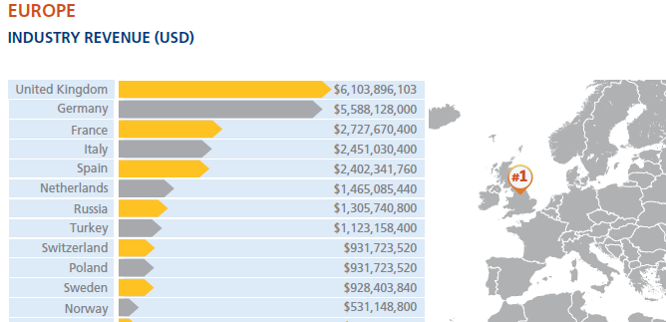

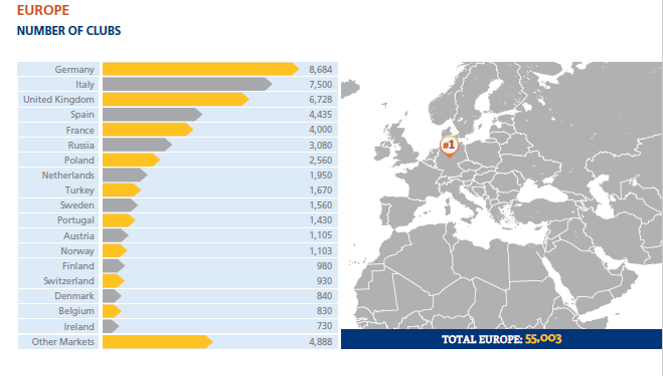

"In the UK, based on research by LeisureDB, 9.7 million people belong to a private corporate health club, up from 9.3 million a year ago. Approximately 6,728 facilities in the UK generate a collective US$6.1 billion in industry revenue. Germany attracts more than 10 million members to 8,600 facilities and generates US$5.6 billion in revenue."

Original Source: Health Club Management

** The 2017 State of the UK Fitness Industry Report can be downloaded via the link **

You And Yours - BBC Radio 4

David spoke with Samantha Fenwick, a reporter for 'You and Yours' (BBC Radio 4 programme) about the UK fitness industry. The number of gym memberships are increasing every year and David says that "group fitness is driving the industry growth as classes are no longer held in boring studios...operators are making gym experiences more enjoyable". Les Mills UK and Sport England commented on the increase in group exercise participation and how technology, such as virtual reality, will change group fitness forever.

Listen to the full clip here: http://www.bbc.co.uk/programmes/b08x4rf3

July: Workout

Stats from the LeisureDB 2017 State of the UK Swimming Industry Report were published in the July issue of Workout magazine.

Original Source: Workout

July: Gym Owner Monthly

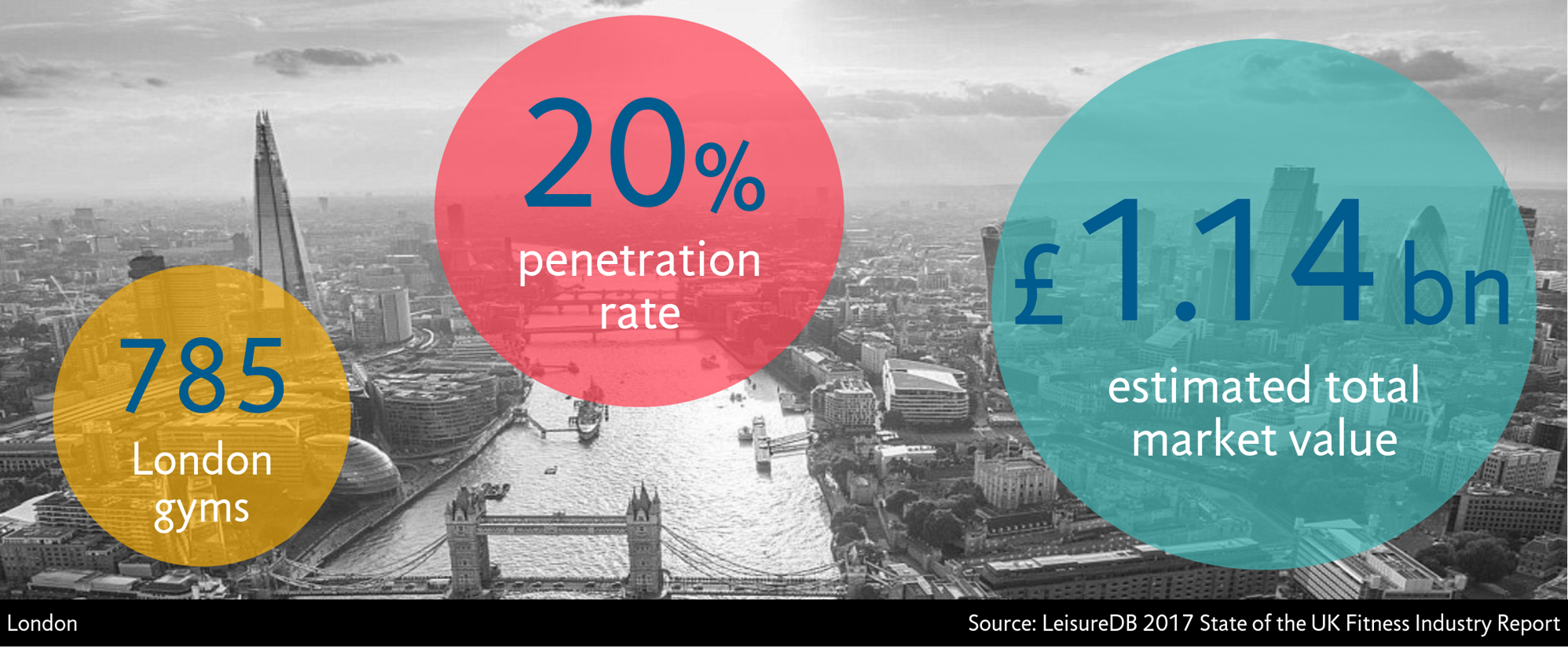

Focus on London...

The 2017 State of the UK Fitness Industry Report reveals that there are now 6,728 fitness facilities in the UK with 12% of the sites being in London.

London alone has a staggering 1.7 million fitness members, that’s 1 in every 5 people in London being a member of a gym compared to 1 in every 7 within the UK.

The fitness industry within London has a market value of £1.14 billion (24% of the overall UK market value) and a penetration rate of 20%.

Original Source: Gym Owner Monthly

Flame2017

Wednesday was the annual #Flame2017 event run by UKActive & what a brilliant event it was. The day was spent attending a varied range of talks hosted by Olympic athletes to tech experts and the night was a fun-filled evening of awards, dancing & gin.

The event kicked off with a thought provoking talk by Steven Ward, CEO of UKActive as he discussed the growing importance of promoting physical activity within the UK. Followed by Dave Wright, CEO of Myzone, who recently launched free virtual classes and a chat feature for trainers.

Two keynote speakers then took over the stage - Jonathan MacDonald, the founder of Thought Expansion Network followed by Luis Huete, a business school professor & author.

For the breakout sessions we attended two talks. The first by professional skipper, Alex Phillips who has spent an astounding 17 years at sea and travelled over 150,000 miles on the water. Back in 2000 she managed the yacht "Quadstone" in the BT Global Challenge, also known as "The World's Toughest Yacht Race". The race involves navigating a 70ft steel yacht 29,000 nautical miles around the world starting in Portsmouth and heading West to East.

The afternoon keynote speaker was none other than track cyclist Jason Kenny, team GB's 6 Olympic Gold medal holder. Kenny and Tanni Grey-Thompson discussed what its like to be a world class athlete and of Kenny's experiences at the Beijing, London and Rio Olympics. A fantastic talk with fascinating insight into the world of professional sport!

The final breakout session of the day was with Professor Andy Miah, a futurist and lover of all things tech. Miah discussed technology trends, the future of sport and fitness and possibility of augmented reality gyms. Miah stated that the "crucial tech parameters of physical activity are mixed reality, mobile health and gamification". The future of sport and fitness is developing through a wide range of tech such as health based mobile apps, esports, wearables, artificial intelligence and ingestible sensors. What sort of possibilities could technology bring to the industry? Why isn't sport made more immersive with the use of technology? An example by Miah was the possibility of projecting the Olympic swimming races live onto pools so spectators could watch and feel part of the experience. And finally, what will it take to create an augmented reality gym? Play. Compete. Develop. Exercise. Research.

The evening was brilliant and team LeisureDB smashed their daily step count by dancing into the early hours of Thursday morning. Sat with the wonderful (& nominated) Jubilee Hall Trust team during the awards ceremony...Congratulations to all of the award winners and runners up! A huge thank you to UKActive for another fantastic Flame event. See you next year!

June: Gym Owner Monthly

Gym Owner Monthly's June issue was published today and stats from our 2017 State of the UK Fitness Industry report have been featured on pg.11 ...

The 2017 State of the UK Fitness Industry report highlights that the UK fitness industry is continuing to grow, with increases of 4.6% in the number of fitness facilities, 5.1% in the number of members and 6.3% in market value.

There are now over 9.7 million fitness members in the UK which has boosted the penetration rate to an all-time high of 14.9%.

David Minton, Director of LeisureDB says: “It may be premature to call the period to 2020 “the golden age of fitness” but further growth will only be limited to the imagination of those pushing the boundaries”.